Compound Startups

software enters its consolidation era

summer is here!! no better time to subscribe to this blog

This year, I’ve noticed more founders describe their businesses as “compound” companies. Borrowing the definition used by Parker Conrad of Rippling, “a compound startup is a startup that instead of just doing one very narrow thing, tries to build a whole set of different point solution systems in one coherent product”.

This is far from the typical Silicon Valley guidance to focus in on a very specific problem. But I think that we’re entering a new era of consolidation in software that favors the compound business approach.

Unbundling Software

The last decade of software can be characterized as a long period of unbundling. The prototypical example is the unbundling of Craigslist. Dedicated startups each tackled a specific Craiglist service or good, attempting to “unbundle” it into a standalone offering. The same megatrend has played out in nearly every category of software and for the most part, I think customers are better for it.

Unbundling resulted in focused companies who were often able to build more comprehensive, superior products than their counterparts. And fortunately for investors, this additional product depth often resulted in market expansion. In other words, people were willing to pay more for standalone products if they were significantly better.

From a company-building perspective, this long period of unbundling was supported both by (i) technology shifts and (ii) the macro environment.

On the technology side, cloud computing was the first major catalyst for software unbundling. It simplified and scaled software delivery. The software market, which previously only supported clunky, on-premise software that relied on heavy implementation services (eg SAP), now also accommodated specialized applications. And as the cloud infrastructure ecosystem evolved, the barriers to building and adopting cloud-based software became very low. Finally, the availability and adoption of APIs made it easier for different applications to communicate and exchange data. As a result, new companies could access data in other systems-of-record and deliver value in new ways.

On the macro side, the growth of venture capital drove more new businesses. The asset class ballooned due to bigger-than-expected software exits, coupled with a declining interest rate environment. The reality is that cloud software markets turned out to be significantly larger than what VCs initially predicted. Bessemer underwrote the best case for Shopify as a $400m exit when in reality they IPO’d around $1.5B and is now worth $70B+. When companies like Shopify turned out to be much larger than anticipated, VCs were able to invest in markets that they might have previously considered too small. With more VC firms and more capital to deploy, money flowed into more unbundled point solutions than before.

Naturally, this confluence of trends has brought unbundling to its culmination, leaving customers with a complex, fragmented set of tools for every pain point. I believe we are at a turning point where we will see more successful “compound” businesses that effectively bundle together multiple products.

Bundling is Back

Today’s market conditions are quite different from the last decade. First of all, the technology trends that powered unbundling have matured and already been commercialized. Even legacy businesses have embraced the cloud, and tech investors have standardized how they assess these SaaS with metrics like net dollar retention, magic number, CAC payback, etc. The once contrarian “software is eating the world” post has become consensus a decade later.

In addition to the maturation of cloud, today’s macro environment is simply less conducive to software buying. After interest rates climbed back up, we saw public market multiples decline, forcing high-growth businesses to prioritize profitability over just growth. To do so, companies are consolidating vendors, optimizing SaaS licensing, and reducing employee headcount. Each of these puts additional pressure on best-of-breed solutions who may be easier to cut or replace.

And no 2023 blog post would be complete without a mention of AI, so here it is. I view this next generation of LLMs as a meaningful enabler of bundling. In the past, software was designed for specific tasks due to the complexity and unique requirements of each task. Startups carved out a niche because no one company could simultaneously build great software for a huge swath of tasks.

But today’s larger, more capable, pretrained models are changing that paradigm. It’s now possible for a single model to tackle a wider range of tasks. For instance, a CRM can go from managing customer relationships to also analyzing sales data, predicting customer behavior, and other functions which it may have deprioritized previously.

Ultimately, individual companies are now better positioned to build multiple AI-powered products than ever before because the technical hurdles to do so are coming down. We’re already seeing large tech companies with access to unique data launch AI products to provide insights, predictions, or chat interfaces on top of the data that they have.

Why Compound Businesses Win

I’ve mainly discussed some of the high-level trends pushing us towards consolidation in software, but at the end of the day customers need to choose compound products over other options. There are certain situations when and where the compound business strategy is most advantageous.

Parker Conrad discusses in more detail some of the reasons that compound businesses excel, but the two areas that are most compelling to me are (i) product integration and (ii) business model flexibility.

Product integration

The most compelling reason to bundle is that you are able to offer an integrated offering across multiple products. There’s multiple benefits here: consistent UI, data availability across products, ease of automation between systems, etc.

As an example, today there are tools that just focus on sales prospecting (who are my leads? what automated emails do I send them?) as well as tools that focus on sales intelligence (eg Gong – conversational intelligence, etc). Both are valuable, but together you may be able to create a product loop where the actual conversations inform what are the most effective email messages.

I actually think there's a misconception that the way to build product quality is to focus very narrowly. And that's the thing that I disagree with the most.

– Parker Conrad, CEO of Rippling

Business model flexibility

From a business perspective, bundling also provides flexibility on how to monetize most effectively. The textbook example here is Microsoft Teams as part of the Office 365 bundle. By coupling Teams with market leading products like Word and Excel, they were able to commoditize Slack which was a standalone competitor to Teams. Microsoft has walked this back due to antitrust, but not before they ran away with the market.

Additionally, compound businesses have flexibility on customer acquisition because customers will have multiple points of entry into the business. The most successful companies here like Atlassian and Hubspot are able to quickly get customers using their broader suite of products.

The Two Types of Compound Businesses

I categorize compound businesses into two distinct groups: 1) multi-product and 2) integrated.

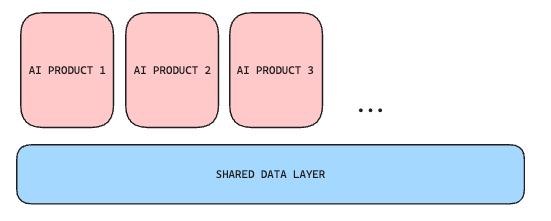

The first group of companies bundle multiple discrete products, aiming to offer a collective value that’s greater than the sum of its parts. Companies like Rippling, Wiz, Hubspot would all fall into this category as they were quick to launch successive products quickly that were related but still separate. These businesses typically have multiple products that sit atop some common horizontal layer. As a result, investing in this horizontal layer benefits all products. In the case of Rippling, the multiple products all benefit from a common layer of permissions, reporting, analytics, and of course the employee data that the core Rippling product captures. Atlassian has a similar benefit, with all of its products benefitting from a common layer of user identity, billing, authentication, etc.

“We can amortize our R&D efforts across multiple products for maximum return. Whenever we invest in new functionality, we build it into the platform supporting all our products instead of building features on an ad-hoc, per-product basis.”

– Atlassian Investor Day 2022

The second group bundles multiple products into a one integrated product by abstracting away the borders between multiple existing products. Slack did this by combining chat, files, email. Notion did something similar with documents, wikis, task management. Both companies ended up creating new categories of products altogether. This group tends to have high NPS products because of their integrated nature. Another flavor of an integrated product is Singlestore, which sells a single database product built for both transactional and analytical workloads. Traditionally, these two use cases had been served by separate products, but the value of bringing the two together is simpler which can make it a more compelling choice for some. Businesses here will likely have to do more work around category creation and marketing given the novelty of most integrated product.

Investing in Compound Startups

I’m confident we’ll see more compound startups emerge in the next few years. Data from one of our portfolio companies, Tropic, already suggests that while small and mid-sized software deals have slowed down, 6-figure deals are actually increasing.

And while bundling is often associated with large companies exercising their scale advantages, I think there’s a place for startups to follow the compound playbook very early on. Fortunately, there are a number of great examples to learn from.

As an investor, these are the questions I think compound startups should consider:

Why is this solution better than using multiple best-of-breed solutions?

When is the right time to launch products 2 through n?

How do I communicate the value of this bundle to customers effectively? Is there a wedge?

How much capital do I need to execute on this multi-product vision?

What is the right way to organize and scale the team to build a compound business?

Are there specific customer segments for which a bundle is particularly compelling?

If you’re building a compound business or have thoughts on how to think about these businesses, don’t hesitate to reach out on twitter or email at nanilal@canaan.com

Have you ever heard of a company called Swit? Your post reminded me of them. Thanks for another great post. (https://www.g2.com/products/swit/reviews)